Answers to frequently asked questions

Bank cards have become an integral part of our life. With their help, we receive a salary, pay for purchases in a store, or simply withdraw money through an ATM. One of the most popular payment systems is Visa. The company was founded back in 1970, when electronic payment systems were just emerging. Later VISA gained popularity all over the world, and today every bank of any country issues cards of this payment system.

Internet users have long appreciated all the advantages that electronic payment systems give them. Cashless payments help speed up financial transfers on the Internet, which affects the development of the Internet environment. In Russia, the practice of electronic exchange of finance has existed for about 10 years. During this time, several payment systems have appeared (Qiwi, Webmoney and others). But in recent years, Russian users are increasingly interested in popular foreign payment systems. And in order to understand what caused this interest, it is necessary to get to know some of them better.

Is it good or bad when there is a large selection? For some, this is unnecessary trouble, for others it is an opportunity to find the ideal option in the process of a thorough search. \\ nThe Internet gives us this opportunity. With the advent of virtual settlement systems, it became necessary to exchange digital currencies. Along with the creation of electronic payment systems, the number of exchange offices is also growing.

Any owner of a decent amount of electronic money thinks about the security of an Internet account. Especially worried about this are those who are accustomed to cash, real, paper bills, which can be folded in a pile, fastened with a tape or special elastic band, put in a box and hidden in a safe under a secure lock. But no matter how Koschey the Immortal hid his death, they still got to her. So this old-regime method can also be subject to elementary theft with housebreaking.

Electronic money transfer systems are specially created structures that receive / transfer money between the receiving and sending parties using software and electronics. All electronic money transfer systems have their own service network, which includes a support service, a settlement center and other departments. Below are the systems that are in the greatest demand today.

When choosing a payment system, people are guided by several criteria - reliability, ease of use and availability. What electronic money is the most popular today? The polls carried out have shown that the following giants are in the leading three winners - Yandex.Money, Qiwi and WebMoney. Below we will consider the features of each of the systems.

Where to get an internet walletElectronic payment systems have become a key part of our life. With their help, you can make transfers, shop online, and pay for various services. But for a full-fledged work, you will have to go...

As you know, any product has a value. If money is a commodity, you can buy it too. Each country has its own currency, as a means of governing the economy, and it has its own rate, that is, value in relation to other currencies. It is impossible to purchase any product abroad for the national currency of your state. To do this, you need to carry out the procedure for buying the required type of money. For example, if a Ukrainian citizen, who has a hryvnia in his hands, wants to purchase goods from the United States, he can do this by exchanging Ukrainian money for American money.

Русский

Русский  English

English  中文

中文  عرب

عرب  Eesti

Eesti  Español

Español  Deutsch

Deutsch  Български

Български  Türkçe

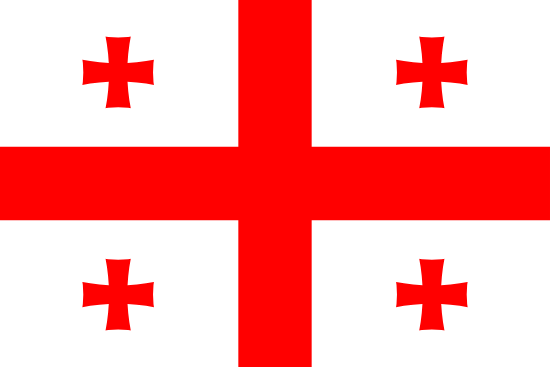

Türkçe  ქართული

ქართული